New scientific model that predicts employed people's real possibilities of buying a flat in Spain

The study reveals that only one in every six employed people in Spain has a real possibility of buying a home of their own

More than half of the people who work and live in Spain would be automatically excluded from buying a house because of their employment conditions, according to the innovative analytic model developed by researcher Óscar Olcina, which predicts the possibilities of buying a home in Spain.

This study earned Olcina first prize in the 5th Big Data Talent Awards, sponsored by Oracle, in the category of final master's degree or postgraduate projects. These awards recognize macrodata, data analysis and artificial intelligence projects that have an significant socioeconomic impact.

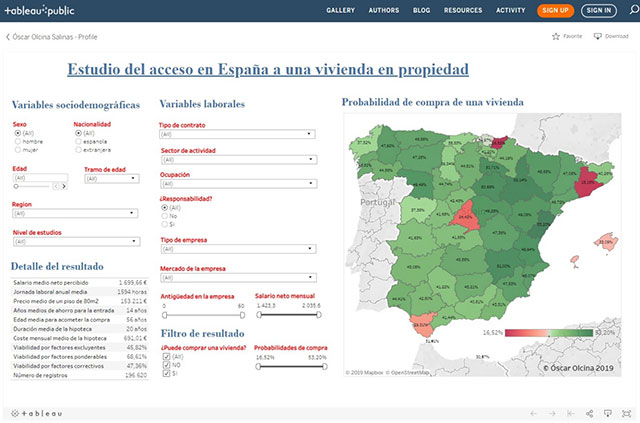

The project, directed by the UOC's Master's Degree in Business Intelligence and Big Data course instructor Diego Miranda-Saavedra, aims to quantify and predict the real possibilities for an employed person in Spain to buy a home of their own, taking into account their income, age, education, place of residence, their job title and responsibilities, and the industry they work in.

When his analytical model is applied, it is clear that "only one in every six employed people in Spain has a real possibility of buying a home of their own". The researcher explained that "54.34% of employed people in Spain (45.29% if the age group is narrowed to the 30-50 range) cannot afford to buy a flat" and "29.76% (33.3% in the 30-50 age group) would find it difficult or very difficult". At present, only 15.9% of Spaniards have a clear possibility of buying a flat, which increases to 21.41% for the 30-50 age group.

"Models like this are not going to solve a particular problem overnight, but they do allow us to see the problem from a new perspective, which was impossible until recently. Now, the problem can be addressed using a predictive approach that people can use to factor in problems arising from situations in their day-to-day life, using this technology to consult very valuable information to help them in their decision-making", the researcher explained.

The difficulties many face in buying a home, Olcina explained, "are associated with a very significant socioeconomic impact". In a recent report, the Bank of Spain suggested that it was now better to buy than rent. However, according to the expert, buying one's own home continues to be "very restrictive" in Spain. Many who want to buy a home "find it impossible, difficult or very difficult to afford it on their own income alone", he said.

A formula for prediction with more than a hundred variables

According to the study, flat prices in Spain are highest in San Sebastián and Barcelona, followed by Madrid, Cádiz and Bilbao. The cities with the highest housing supply are Ciudad Real, Alicante and Salamanca, while the cities and regions where the property market is most sluggish are Madrid, Seville, Pamplona, Canary Islands and the region of Aragón in general. The cities where it is easiest to buy a flat are Zaragoza, Soria, Albacete, Castellón and Logroño.

"This model can be tailored to each individual like a suit made to measure, as it takes into account factors like their exact age, education, where they live, their professional role, the industry they work in, the years they have been working, whether or not they have managerial responsibilities, the market they are targeting, and whether they work in the private or public sector", explained Olcina. "It will not provide just a static picture like a classic report. It can simulate average net salaries in other Spanish cities, the average number of hours that would be worked each year, the average price of a flat measuring 80 m2, the average number of years that you would have to save to make the down payment, the average age for becoming a home owner, the mortgage's average duration, the mortgage's average monthly cost, and different feasibility ratios for determining the possibilities of getting a mortgage, among other factors".

All of this information, generated by over a hundred variables contained in a dozen cross-tabulated data sources, provides enormous help in making a decision as important as buying one's home. Although the model has been designed for use by the general population, it can be applied equally well to other fields such as businesses or government", the researcher assured.

According to the expert, a property portal could offer a clear competitive advantage over its competitors by designing a "made-to-measure suit" like this. Thus, the prospective buyer would no longer be limited to a series of static statistics based on aggregate data but would have information tailored to their personal profile to help them to make their decision. A public authority could also monitor the property market of a city or region much more closely.

House prices rise but salaries stay the same

"Home buying has become a major social problem", Olcina continued. This situation, he added, would take a clear turn for the worse if house prices continued to rise, with less mortgages being granted and salaries staying the same. The economic and social research think tank Funcas said in a recent report that house prices will rise by 2.5% in 2020.

"Property buying is not just a real estate market problem, it is also a salary problem. If salaries increased at a similar rate to house prices, the problem would be minimized; however, we have seen that salaries have stayed the same in recent years (or if there have been any increases, they have been marginal, in the best of cases), while property prices per m2 have shown double-digit growth in some areas. These trends have been continuing for some years and the property market is becoming increasingly unsustainable", he added.

With his model, Olcina explained that any citizen "can measure their buying potential using variables that they know perfectly well". This can also help in making decisions about geographical mobility, "which has become a key factor in buying a home".

Press contact

-

Editorial department